Market Updates: You May Have More Home Equity Than You Think

Posted by Dil Gillani on

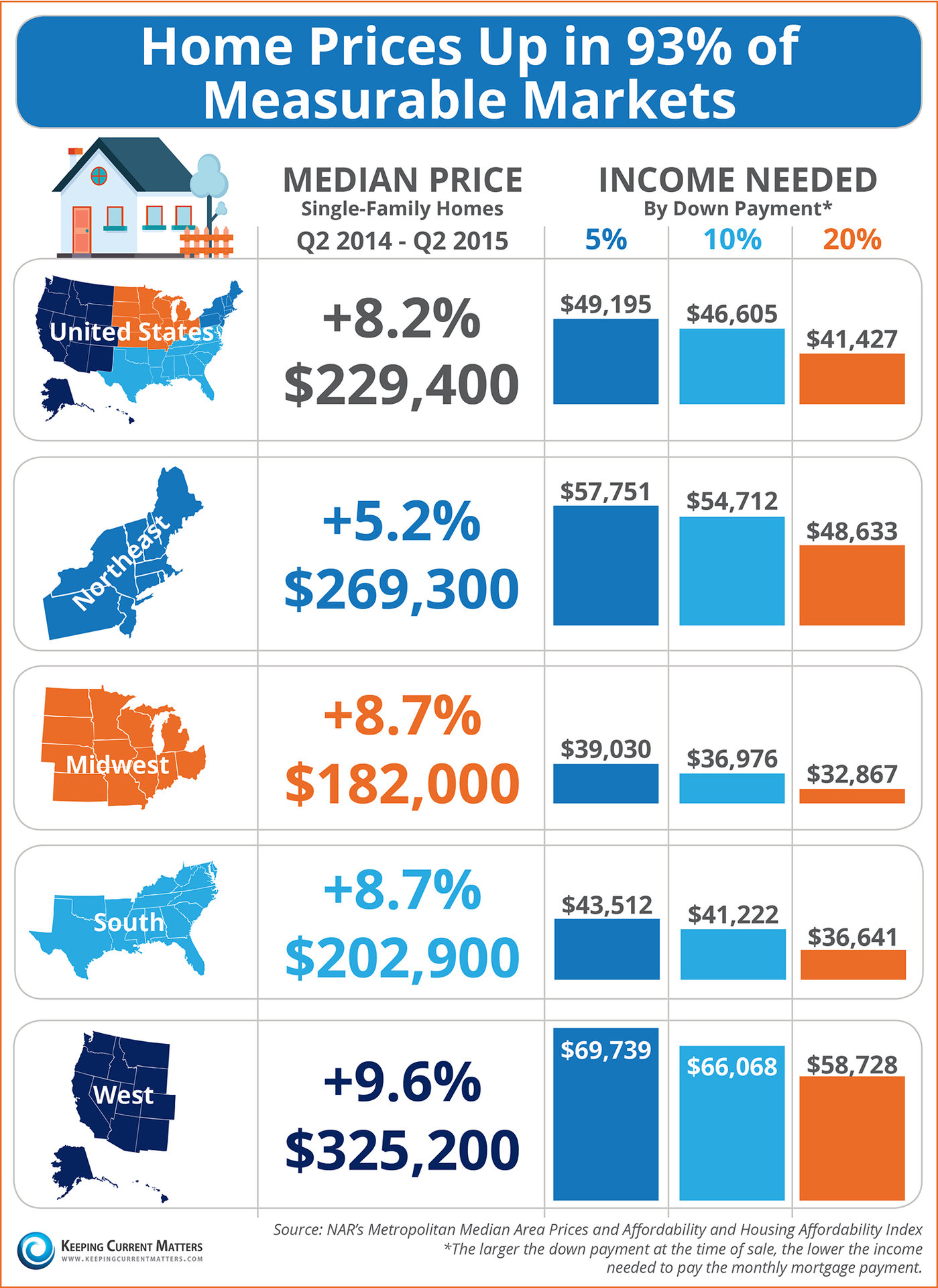

CoreLogic recently released their 2015 2nd Quarter Equity Report which revealed that 759,000 properties had regained equity in the last quarter. That means that 91% of allmortgaged properties (approximately 45.9 million) are now in a positive equity position. Anand Nallathambi, president and CEO of CoreLogic, reported:

“For much of the country, the negative equity epidemic is lifting. The biggest reason for this improvement has been the relentless rise in home prices over the past three years which reflects increasing money flows into housing and a lack of housing stock in many markets.”

Obviously, this is great news for the financial situation of many homeowners.

But, do they realize their equity position has changed?

A recent…

1250 Views, 0 Comments

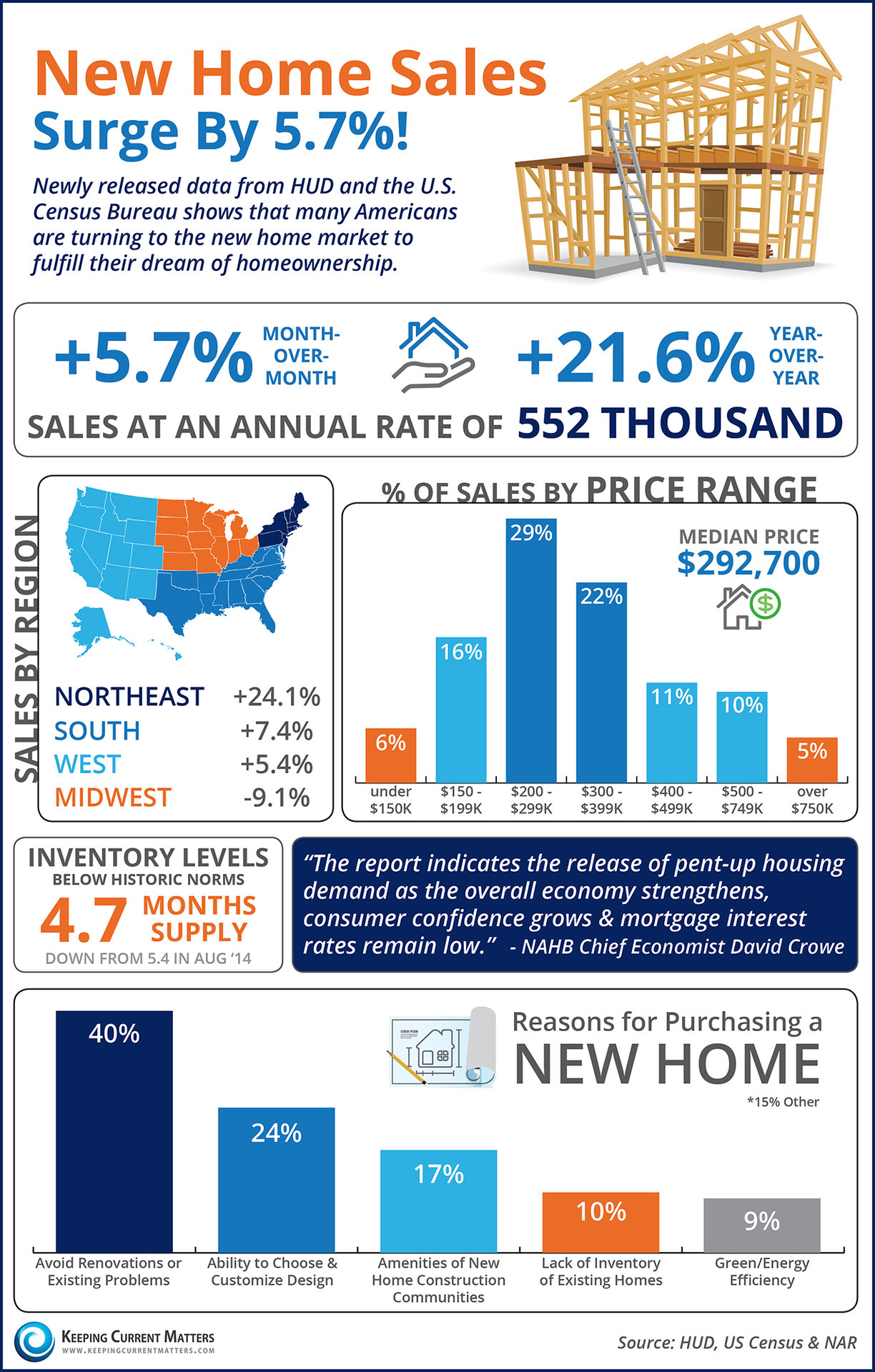

It's that time of the year; the seasons are changing and with them bring thoughts of the upcoming holidays, family get-togethers, and planning for a new year. Those who are on the fence about whether now is the right time to buy don't have to look much further to find four great reasons to consider buying a home now instead of waiting.

It's that time of the year; the seasons are changing and with them bring thoughts of the upcoming holidays, family get-togethers, and planning for a new year. Those who are on the fence about whether now is the right time to buy don't have to look much further to find four great reasons to consider buying a home now instead of waiting.

Many have been wondering when the much anticipates move by Millennials' into homeownership would actually take place. We know the belief in owning a home is there.

According to a recent Merrill Lynch study, eighty one percent of Millennials believe "homeownership is an important part of the American Dream." This compares favorably to previous generations.

The obstacle seemed to be employment, but it appears that is about to change.

The most recent jobs report disappointed many economists. However, the silver lining in that could of doubt was Millennials. Jonathan Smoke, realtor.com Chief Economist, reported:

Many have been wondering when the much anticipates move by Millennials' into homeownership would actually take place. We know the belief in owning a home is there.

According to a recent Merrill Lynch study, eighty one percent of Millennials believe "homeownership is an important part of the American Dream." This compares favorably to previous generations.

The obstacle seemed to be employment, but it appears that is about to change.

The most recent jobs report disappointed many economists. However, the silver lining in that could of doubt was Millennials. Jonathan Smoke, realtor.com Chief Economist, reported:

![Where Will Home Prices Be Next Year? [INFOGRAPHIC] | Keeping Current Matters](http://www.keepingcurrentmatters.com/wp-content/uploads/2015/10/Home-Prices.jpg)