Market Updates: Existing Home Sales Slow Amongst Tight Inventory

Posted by Dil Gillani on

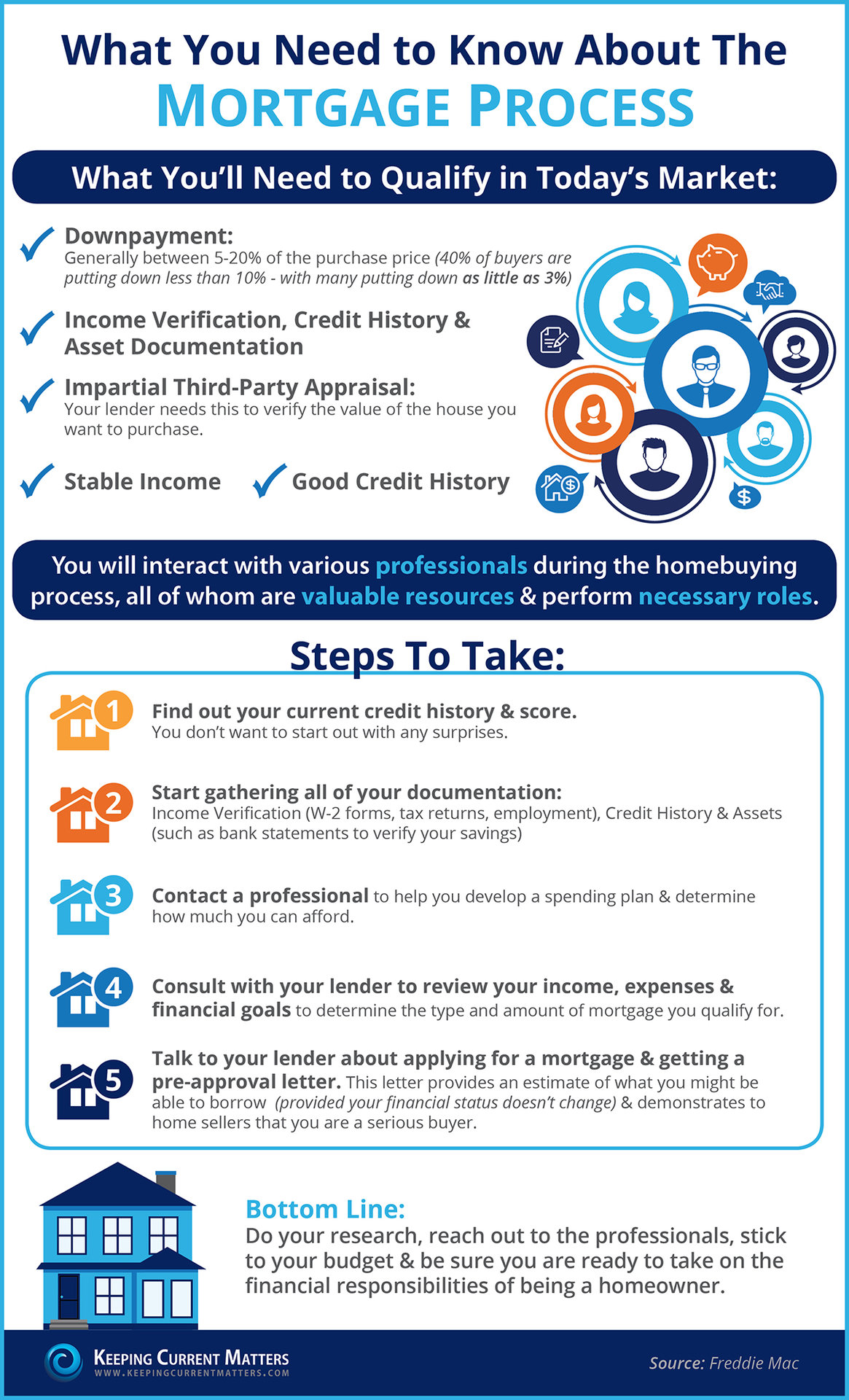

In today's Market Updates series, we bring you another info-graphic from our friends over at KCM (KeepingCurrentMatters.com).

According to the info-graphic above, Lawrence Yun - the NAR Cheif Economist said, "With sales and overall demand higher than a year ago and supply mostly unchanged, low inventories will likely continue to limit options for those looking to buy this fall."

Inventory levels are still below historic norms, down 107% from August 2014. First time buyers made up 32% of sales, matching the previous May 2015 high. 40% of homes are being sold in less than a month.

With inventory so low, but demand so high, there is no better time than right now to put your house on the market!

Call us today for a free house estimate! 718-442-4400

1098 Views, 0 Comments

Whether you are buying or selling, hiring a real estate agent holds many advantages for everyone involved in the buying/selling process. They understand all the paperwork that has to be filled out, know all the tips and tricks for negotiating deals, have knowledge and experience in all aspects of real estate, know the proper values of any home, and have a clear understanding of the current market conditions. Hiring a real estate agent makes every step of buying or selling a home a simpler process. You'll have a cunning and educated person taking care of all…

Whether you are buying or selling, hiring a real estate agent holds many advantages for everyone involved in the buying/selling process. They understand all the paperwork that has to be filled out, know all the tips and tricks for negotiating deals, have knowledge and experience in all aspects of real estate, know the proper values of any home, and have a clear understanding of the current market conditions. Hiring a real estate agent makes every step of buying or selling a home a simpler process. You'll have a cunning and educated person taking care of all…